Introduction

Introduction

AI‑assisted signal quality

- Using AI‑inspired machine‑learning filter noisy conditions and highlights higher‑probability signals.

- Adjustable confidence thresholds let you balance signal frequency vs. quality for your market and timeframe.

Professional risk management

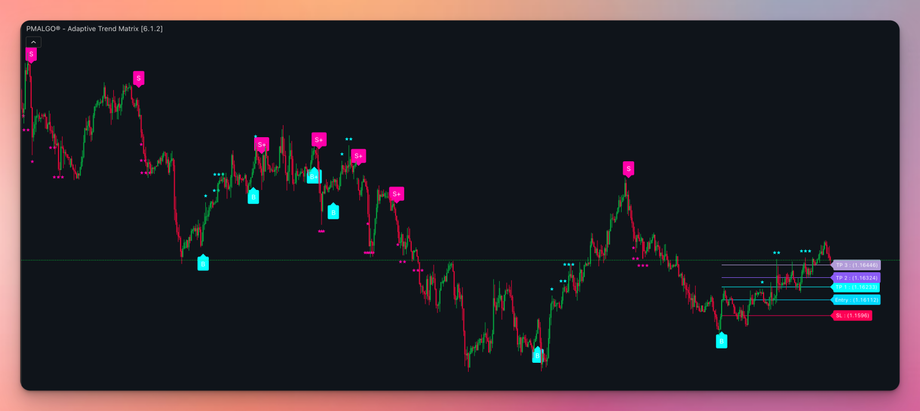

- Dual modes: ATR‑Based (classic volatility scaling) or Fixed Risk:Reward (SL defined by ATR multiple; TP1/TP2/TP3 derived from SL distance).

- Automatic plotting of Entry, TP1, TP2, TP3, and SL, plus first‑hit detection so you instantly see which target broke first.

Execution‑ready visuals

- Clean buy/sell labeling (B, B+, S, S+), optional bar coloring, and star markers (★/★★/★★★) on initial TP breakouts.

- Theme‑aware interface with a polished dashboard, including a Cyberpunk style for high‑contrast readability.

Alerts for automation

- Pro‑grade alert suite: specific TP1/TP2/TP3 hits, Stop Loss hits, bullish/bearish signals (normal/strong), and trend changes.

- Supports TradingView placeholders (e.g., {{plot("Entry")}}, {{plot("TP1")}}) for precise webhook messages and bot workflows.

Multi‑timeframe market context

- MTF dashboard snapshot (e.g., 1H, 2H, 4H, 8H, 1D) shows alignment or conflict across horizons.

- EMA‑based trend read, optional ML section (prediction and confidence), and adaptive color logic for light/dark charts.

Advanced confluence tools (optional)

- Support/Resistance zones with extend/zone width controls.

- Supply/Demand POIs with non‑overlap logic and BOS conversion on breaks.

- Market Structure (HH/LH/HL/LL, BOS/CHoCH) with configurable styles.

- Auto Trend Lines with extend and style options.

Who It’s For

- Swing, intraday, and position traders across crypto, forex, indices, and equities who want structured, repeatable setups.

- Traders who prefer clean entries with predefined TP/SL, automated alerts, and minimal chart clutter.

- Users who value multi‑timeframe confirmation, disciplined Risk:Reward planning, and the option to filter signals with AI‑inspired logic.

TL;DR: ATM helps you identify direction, define risk, set targets, and manage alerts—consistently and fast.

Recommendation: It is advisable to use the Adaptive Trend Matrix in conjunction with the Premium Oscillator. Adjust the sensitivity based on the time frame and symbol you are trading.